What we've announced at XCHLDN

It was a packed day at XCHLDN, we’ve announced liquidity rewards for offers and auto dexie, a tool for liquidity providers. In this post, we want to provide a summary for those, who couldn’t attend.

Liquidity

Liquidity refers to the ease with which an asset can be bought or sold in the market without causing significant price fluctuations.

Liquidity is important because it reduces transaction costs, enhances price stability, and overall market efficiency. A highly liquid market allows for quick transactions at a fair price, and even reduces market manipulation risks.

More liquidity can be a positive feedback loop where it attracts more market makers who will provide even more liquidity.

Currently one of the biggest issues on dexie is low liquidity, so we came up with ideas to improve that.

Liquidity Rewards for Offers

The Liquidity Incentive Program aims to improve the liquidity on dexie by encouraging market makers to create offers on dexie within a specified spread of the current market price. Market makers who create qualifying offers will receive rewards in DBX tokens.

Rewards are based on the proximity of the offer price to the market price and the offered amount. Offers closer to the market price receive higher rewards. To ensure a fair reward distribution, snapshots of the order book are taken at random intervals, averaging 5 minutes apart. As long as an offer is active and within the specified spread and range, it will be included in the reward calculation.

Each incentivized asset pair is assigned a reward rate in DBX tokens, which is shared among all qualifying offers within the pair.

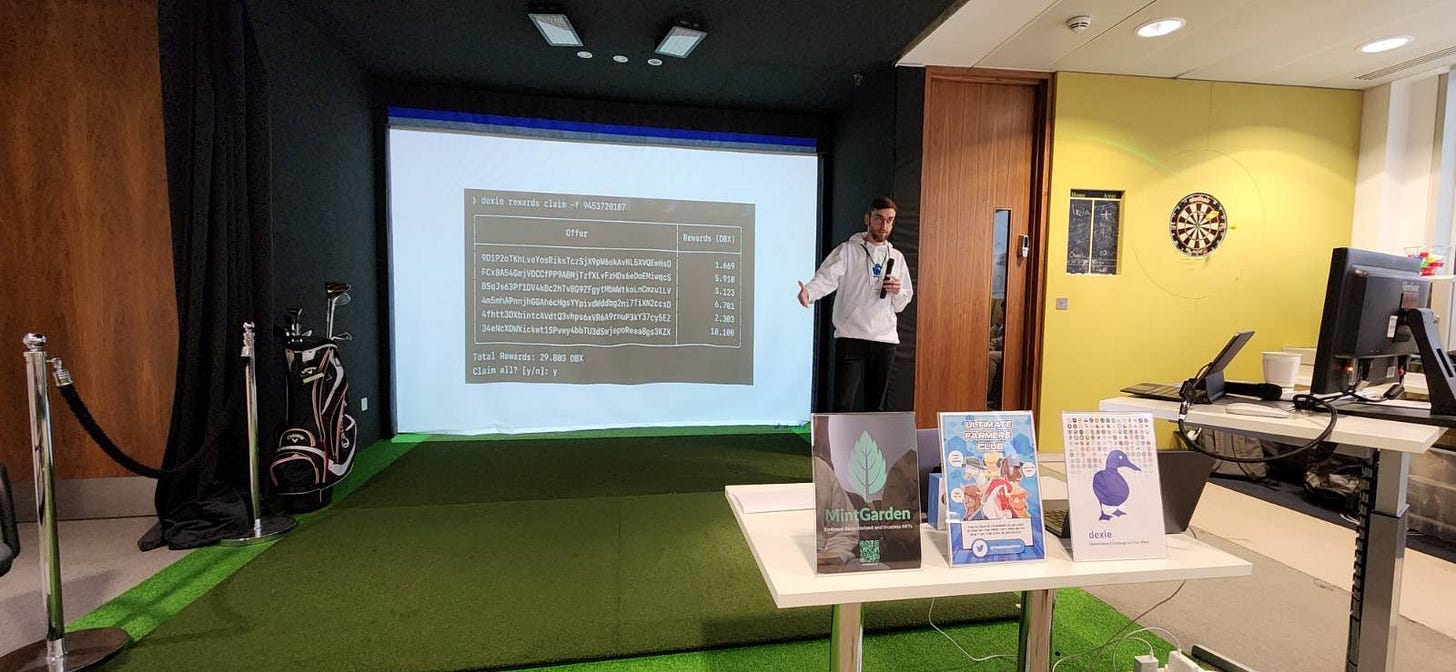

Rewards can be claimed either on the Your Added Offers page by clicking the Claim button or by using our auto-claim tool. The claim tool is an open source Python tool which runs locally and will automatically claim rewards for all your created offers.

The Liquidity Incentive Program not only encourages liquidity, it also allows for a fair distribution of our governance token and helps to decentralize dexie's ownership.

It is set to launch this month! And who knows, offers might already be earning rewards. 😉

auto dexie

But there's more! Providing liquidity with offers can be hard to execute efficiently. Market makers must continually monitor their offers and may even need to handle coin splitting. To simplify this process, we are preparing to launch auto dexie!

auto dexie is a tool for liquidity providers to run locally on their node or farmer. It creates offers based on a chosen liquidity or trading strategy and even takes care of splitting coins. It's very flexible, meaning market makers can easily adapt or code their own strategies — fully non-custodial.

Together with expiring offers, it will become an efficient tool to provide liquidity, and can be, for example, enhanced to follow a price oracle or other external events, which AMMs can not do.

It's fully based on Chia offers, which means, in theory, you could even provide liquidity to multiple offer DEXs at once!

This tool will be, of course, completely open source.

So, what’s up with AMMs?

We've seen some serious progress with AMMs (automated market makers) recently on Chia, which is exciting.

AMMs are effective in providing initial liquidity for new tokens with undeveloped prices or tokens not influenced by external factors. They are specifically useful in illiquid markets, as they will always provide someone to trade with.

AMMs also offer passive income opportunities for market makers and can be fully decentralized, in theory allowing interaction without a website.

There are however a few important downsides.

The way an AMM trades is locked into code. Everyone who provides liquidity to an AMM (LPs) trades exactly the same way. This is inefficient, because the only way LPs can make a profit, is by trading fees. Those fees however, are shared among all LPs evenly, resulting in mostly low returns.

Additionally, AMMs always trade uninformed which leads to value leakage due to external factors. Let’s say the Bitcoin price rises, due to external events. Active market makers on dexie will quickly adjust their positions (offers), which will make the price rise on dexie too. The AMM however, won’t know about this and will continue to sell Bitcoin for a discount until the balance of assets is restored. Arbitrage traders make use of this and constantly pull value out of AMMs.

To summarize: AMMs are good for exchanging smaller amounts, work well in mostly illiquid markets and are an option for passive market makers. However, in very liquid markets with deep order books or for assets which are mainly influenced by external events, AMMs may not perform well. Active market makers have more opportunities in order based DEXs like dexie, and takers benefit from a much lower slippage.

Recap

Liquidity rewards will enhance liquidity on dexie and enable the fair distribution of our governance tokens (DBX).

auto dexie will make it much easier to provide liquidity on dexie, fully based on offers and secure. Funds are never locked and are accessible at any time. Simply “using” the coins which provide liquidity on dexie, is enough to cancel all offers for it automatically.

We believe an order book DEX build on Chia offers is superior to AMM based DEXs, especially in terms of capital efficiency and security for both makers and takers. Less complexity is important when the stakes are high.

Thanks everyone, see you on dexie!